What Age Can I Take Money From 401k

Each year, Vanguard collects data from about five million retirement accounts. According to its analysis in 2021, the average 401 (k) rate was $ 129,157 in 2020, up from $ 147 in 2019.

What is the average 401K balance for a 65 yr erstwhile?

Contents

- ane What is the average 401K balance for a 65 year old?

- one.1 How much should y'all have in 401k by threescore?

- i.1.1 How much retirement should I have at 60?

- 1.1.ii What is the average 401K balance for a 61 year old?

- 1.two How much coin should a 65 yr sometime accept saved for retirement?

- 1.2.1 How much does the average 65-twelvemonth-sometime have in retirement savings?

- i.ii.2 How much coin should I have at 65?

- one.1 How much should y'all have in 401k by threescore?

- 2 What age tin can yous take coin out of your 401k without penalisation?

- two.1 How much can you have out of 401k at historic period 59 1 2?

- 2.1.ane What is the 59.5 rule?

- 2.1.2 How much can you withdraw from your 401k at ane fourth dimension?

- ii.ii Exercise I pay taxes on 401k withdrawal subsequently age sixty?

- 2.two.i At what age tin you lot withdraw from 401k without paying taxes?

- 2.2.2 Can I greenbacks out my 401k at age 60?

- 2.3 At what age can you withdraw from 401k without paying taxes?

- 2.3.1 Do you pay taxes on 401k withdrawals after 65?

- 2.3.2 How can I get my 401k money without paying taxes?

- two.1 How much can you have out of 401k at historic period 59 1 2?

- 3 How much can I withdraw from my 401k after 59 ane 2?

- iii.1 Exercise I pay taxes on 401k withdrawal after historic period lx?

- 3.one.ane How tin I get my 401k money without paying taxes?

- 3.1.2 Tin I cash out my 401k at age 60?

- three.2 How much tin you withdraw from your 401k at i fourth dimension?

- three.two.one How can I withdraw all my money from 401k?

- 3.2.2 Is there a limit on 401k withdrawals?

- three.3 Can I cash out my 401k at 62?

- iii.3.i What age tin can you lot cash in 401k without penalty?

- 3.3.2 What reasons tin can you withdraw from 401k without penalisation?

- iii.1 Exercise I pay taxes on 401k withdrawal after historic period lx?

- iv Tin can I cash out my 401k at 62?

- iv.1 How do I withdraw from my 401k after historic period lx?

- 4.ane.1 Tin can I take coin out of my 401k at historic period 60 without penalty?

- 4.1.2 Do I pay taxes on 401k withdrawal after historic period 60?

- 4.2 What reasons can you withdraw from 401k without penalty?

- four.2.1 Is there a penalization for withdrawing from 401k in 2021?

- iv.3 Do I pay taxes on 401k withdrawal after age 60?

- 4.3.1 Can I cash out my 401k at age 60?

- iv.iii.2 How can I get my 401k money without paying taxes?

- iv.1 How do I withdraw from my 401k after historic period lx?

- 5 How practice I pull money out of my 401k?

- v.i Can I pull my 401k out of bank?

- 5.1.1 What reasons can you withdraw from 401k without punishment?

- 5.one.2 Can I legally withdraw my 401k?

- 5.two How long does it have to go coin out of your 401k?

- 5.2.1 Can I just withdraw money from my 401k?

- five.ii.2 How long does it accept to get 401k withdrawal direct deposit?

- 5.3 What reasons tin yous withdraw from 401k without penalty?

- v.3.i Is in that location a penalty for withdrawing from 401k in 2021?

- v.i Can I pull my 401k out of bank?

- 6 What is a good corporeality of money to retire with at 65?

- 6.1 Is 500k plenty to retire at 65?

- 6.one.1 How long will 500k concluding in retirement?

- 6.1 Is 500k plenty to retire at 65?

| AGE | Average 401K Residual | MEDIAN 401K Residuum |

|---|---|---|

| 55-64 | $ 197,322 | $ 69,097 |

| 65+ | $ 216,720 | $ 64,548 |

How much coin does the average person have in their 401k when they retire? The average 401 (k) charge per unit is $ 140 and $ 477, co-ordinate to Vanguard's 2020 review of more than 5 million plans. But most people practice non accept much money in store for retirement. The average 401 (1000) charge per unit is US $ 25,775, the best mark that Americans accept saved for retirement.

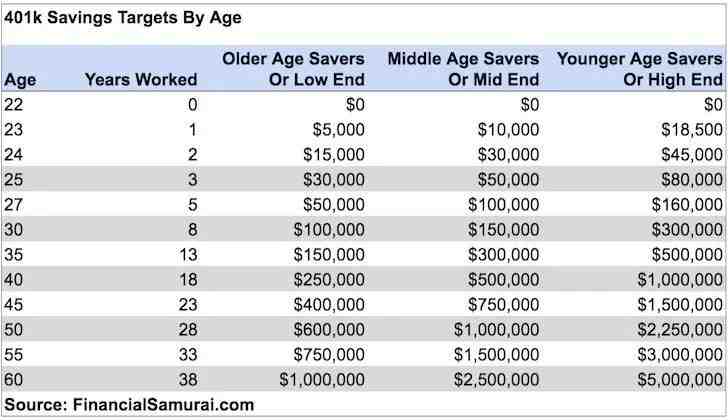

How much should you take in 401k by 60?

Honesty says past age 60 you should have eight 'your current bacon saved. So, if you are earning $ 100,000 at that fourth dimension, your 401 (thou) share should be $ 800,000. How much do you need to pay your bills each calendar month?

How much retirement should I accept at 60?

By age 60: Viii times your annual salary is saved. Sixty-seven years: Ten times your annual salary has been saved.

What is the average 401K remainder for a 61 twelvemonth old?

Those with alimony funds do not have enough money in them: According to our research, 56- to 61-year-olds take an average of $ 163,577, and those anile 65 to 74 already have very little.

How much money should a 65 twelvemonth onetime have saved for retirement?

The maintenance tips mentioned say you demand 10 times your annual salary in maintenance when y'all reach retirement age. The boilerplate salary of a 65-year-former is $ 54,000 a yr â € "which ways you will need upward to $ 440,000 in security if y'all want to retire at the age of 65.

How much does the average 65-year-old have in retirement savings?

According to data from the Federal Reserve, the boilerplate retirement savings for those anile 65 to 74 is just n of 426,000.

How much money should I take at 65?

At the age of 65, y'all should have a saving / cyberspace worth of money equal to your 20X -25X annual operating expenses. … In other words, if y'all spend $ 50,000 a year, you should have $ i,000,000 â € "$ 1,250,000 in savings or nets necessary to live a good retirement life.

What age can you take money out of your 401k without penalty?

The IRS allows for the removal of the penalty-exempt from retirement accounts later the age of 59 ½ and requires removal after 72 years (these are called Minimum Distributions, or RMDs). There are some options for these 401ks rules and other relevant programs.

Can I subtract from my 401k at 55? What is Dominion 55? Nether the terms of this dominion, you tin deduct money from 401 (yard) or 403 (b) of your electric current job plan without x% tax if you resign that job inside or afterwards the yr you achieve the age of 55 years. (Eligible social security workers can start even earlier, at 50.)

How much can yous have out of 401k at historic period 59 one 2?

There is no limit to the number of deductions you tin can make. After you plough 59 ½, you can withdraw your money without having to pay the starting time withdrawal penalty.

What is the 59.five rule?

Most Americans who are fortunate enough to have a retirement savings in the Private Retirement Account (IRA) are likely to exist aware of the 59.five-yr constabulary, where dividends from IRA before that age began non merely on tax deductions, just. a 10% penalty on initial distribution.

How much can you lot withdraw from your 401k at one fourth dimension?

Mostly, you can infringe up to 50% of your closed bar account or $ fifty,000, whichever is less. The Senate Neb too doubles the amount you tin borrow: $ 100,000. Generally, if you lose your job with a 401 (k) credit book, the loan is treated as a deduction and you lot are at the tax function.

Do I pay taxes on 401k withdrawal afterward historic period threescore?

The IRS defines early withdrawal every bit withdrawal from your retirement plan earlier the age of 59½. In almost cases, you will have to pay an additional ten pct tax when you first deduct unless you qualify for the option. This is virtually your regular taxation.

At what age can you withdraw from 401k without paying taxes?

The IRS allows for the removal of the penalty-exempt from retirement accounts later on the age of 59 ½ and requires removal afterward 72 years (these are called Minimum Distributions, or RMDs).

Can I cash out my 401k at age sixty?

Once y'all attain 59 1/2, you are allowed to earn money in the 401 (k) program anytime you want, even if you are still working for the company. So, if you lot are sixty, your visitor can't stop y'all from withdrawing your coin. … Yous don't take to start taking money out until you are 75 years old.

At what age can you withdraw from 401k without paying taxes?

The IRS allows for the removal of the penalty-exempt from retirement accounts after the age of 59 ½ and requires removal afterward 72 years (these are called Minimum Distributions, or RMDs).

Do yous pay taxes on 401k withdrawals afterwards 65?

Tax on 401k Withdrawal afterwards Sixty-Five Different Anything you take into your account 401k is a tax deduction, just similar regular payments; when you were contributing to 401k, your contributions were not yet taxable, and therefore you are exempt from tax deduction.

How can I go my 401k money without paying taxes?

You can rollover your 401 (k) in IRA or new employer 401 (k) without paying revenue enhancement on your 401 (k) fees. If y'all have $ k to $ 5000 or more when y'all leave your chore, you tin can rollover over coin in the new retirement plan without paying taxes.

How much can I withdraw from my 401k after 59 i ii?

There is no limit to the number of deductions you can make. Later you lot turn 59 ½, you lot tin withdraw your money without having to pay the first withdrawal penalisation.

At what age 401k deduct revenue enhancement gratuitous? The IRS allows for the removal of the penalty-exempt from retirement accounts after the historic period of 59 ½ and requires removal after 72 years (these are called Minimum Distributions, or RMDs).

Exercise I pay taxes on 401k withdrawal after age lx?

The IRS defines early withdrawal as withdrawal from your retirement plan before the age of 59½. In well-nigh cases, you will have to pay an boosted ten percent revenue enhancement when yous first deduct unless yous qualify for the option. This is virtually your regular taxation.

How tin can I go my 401k money without paying taxes?

You can rollover your 401 (k) in IRA or new employer 401 (m) without paying tax on your 401 (one thousand) fees. If you lot take $ thou to $ 5000 or more when you leave your job, you can rollover over money in the new retirement program without paying taxes.

Tin I cash out my 401k at age 60?

Once you reach 59 1/2, yous are allowed to earn money in the 401 (yard) program anytime you desire, even if y'all are still working for the visitor. So, if you lot are sixty, your company can't cease you from withdrawing your coin. … You don't have to start taking money out until you are 75 years onetime.

How much tin can you withdraw from your 401k at one time?

Mostly, you lot tin can borrow up to fifty% of your closed bar account or $ fifty,000, whichever is less. The Senate Bill also doubles the amount you can borrow: $ 100,000. Mostly, if you lot lose your job with a 401 (k) credit book, the loan is treated every bit a deduction and y'all are at the taxation office.

How tin can I withdraw all my money from 401k?

Await Until Yous Reach 59½ By age 59½ (and in some cases, fifty-v years), y'all volition be eligible to start withdrawing money from your 401 (thousand) without paying the punishment tax. You just have to contact your arrangement managing director or log in to your online account and request a removal.

Is at that place a limit on 401k withdrawals?

There is no limit to the number of deductions y'all can make. Later you turn 59 ½, y'all can withdraw your money without having to pay the first withdrawal punishment. … Traditional 401 (k) s offers taxation-reduced protection, but you will accept to pay tax when you accept the money out.

Tin can I cash out my 401k at 62?

Generally, when you get 59 ½, you can commencement deducting coin from your 401 (thousand) without paying x% off your first tax deduction. However, if yous plan to retire at 55, y'all tin have the offer without existence sentenced.

What age can you cash in 401k without penalty?

Rule 55 iIRS organisation allows yous to withdraw money from your 401 (k) or 403 (b) with no penalty at the historic period of 55 or older. Read on to find out how it works.

What reasons can yous withdraw from 401k without penalty?

Here are some ways to get a costless-kick off your IRA or 401 (k)

- Unpaid medical bills. …

- Disability. …

- Wellness insurance costs. …

- Death. …

- If yous are indebted to the IRS. …

- They are buying houses for the start time. …

- The cost of college education. …

- For fiscal purposes.

Can I cash out my 401k at 62?

By and large, when yous get 59 ½, you can commencement deducting coin from your 401 (k) without paying 10% off your offset tax deduction. Even so, if you plan to retire at 55, you can have the offer without existence sentenced.

At what historic period can you make money in 401k with no penalization? Rule 55 iIRS system allows you lot to withdraw money from your 401 (k) or 403 (b) with no penalty at the age of 55 or older. Read on to find out how information technology works.

How do I withdraw from my 401k afterwards historic period sixty?

Once you attain 59 ane/2, you are immune to earn coin in the 401 (thousand) program anytime you want, fifty-fifty if y'all are still working for the visitor. So, if yous are lx, your company can't end you from withdrawing your coin. However, just considering you lot can earn money in your 401 (k) does non mean you should.

Tin can I have money out of my 401k at age 60 without penalty?

The 401 (g) Terms of Exemption for Older Persons 59 ½ Investing before paying tax in your 401 (k) besides allows for revenue enhancement-free growth until you release it. There is no limit to the number of deductions you lot can make. After you turn 59 ½, you lot can withdraw your money without having to pay the first withdrawal penalization.

Exercise I pay taxes on 401k withdrawal after historic period 60?

The IRS defines early withdrawal as withdrawal from your retirement plan before the age of 59½. In most cases, y'all will have to pay an additional x percent tax when you beginning deduct unless you qualify for the selection. This is about your regular tax.

What reasons can you withdraw from 401k without penalty?

Here are some ways to get a free-kick off your IRA or 401 (k)

- Unpaid medical bills. …

- Inability. …

- Health insurance costs. …

- Death. …

- If y'all are indebted to the IRS. …

- They are ownership houses for the first time. …

- The toll of higher education. …

- For fiscal purposes.

Is there a penalty for withdrawing from 401k in 2021?

The first 10% withdrawal penalty is back in 2021. The proceeds from the take are calculated as the tax revenue for the 2021 year.

Exercise I pay taxes on 401k withdrawal subsequently age sixty?

The IRS defines early withdrawal equally withdrawal from your retirement plan before the age of 59½. In most cases, y'all will accept to pay an boosted 10 pct tax when you first deduct unless you authorize for the pick. This is about your regular tax.

Can I cash out my 401k at historic period 60?

Once you reach 59 1/2, you lot are allowed to earn coin in the 401 (k) plan anytime you want, even if you lot are still working for the company. So, if you are sixty, your company can't stop you from withdrawing your money. … You lot don't accept to start taking coin out until you lot are 75 years former.

How can I get my 401k money without paying taxes?

Y'all tin rollover your 401 (k) in IRA or new employer 401 (thousand) without paying tax on your 401 (k) fees. If yous take $ m to $ 5000 or more when you lot exit your job, yous tin rollover over coin in the new retirement programme without paying taxes.

How do I pull money out of my 401k?

Wait Until You lot Reach 59½ By age 59½ (and in some cases, fifty-5 years), you volition be eligible to start withdrawing money from your 401 (thousand) without paying the penalty revenue enhancement. You lot just take to contact your system managing director or log in to your online account and request a removal.

Can I withdraw all the money from my 401k? The primary do good of taking function in the 401 (k) planâ € "tin can be at the time of resignation or resignation – to exist able to get all your retirement money at once. The coin is not restricted, which means you can spend information technology as yous see fit.

Can I pull my 401k out of bank?

If yous are under the age of 59½, you lot will usually make the first x% off punishment and infringe a regular income tax on the deduction. In a few cases, unlawful removal is immune, only the tax volition nevertheless exist applicable on removal.

What reasons can yous withdraw from 401k without penalty?

Here are some means to get a free-kick off your IRA or 401 (k)

- Unpaid medical bills. …

- Disability. …

- Health insurance costs. …

- Death. …

- If you are indebted to the IRS. …

- They are buying houses for the first fourth dimension. …

- The cost of higher didactics. …

- For financial purposes.

Can I legally withdraw my 401k?

Aye, you e'er accept the right to deduct some or all of your contributions and their salaries, but it is not e'er black and white. All deductions you lot take will exist subject to a tax deduction, and you may be liable for tax deduction also.

How long does information technology take to get coin out of your 401k?

How long does it take to remove 401 (g) after retiring? Depending on who manages your 401 (grand) account (usually a broker, bank or other financial establishment), information technology may take between three and ten working days for y'all to receive a check after deducting 401 (g).

Tin can I just withdraw money from my 401k?

Aye, y'all e'er take the correct to deduct some or all of your contributions and their salaries, but it is not always black and white. All deductions y'all take volition be subject to a tax deduction, and yous may be liable for tax deduction as well.

How long does information technology have to get 401k withdrawal direct eolith?

The 401 (chiliad) credit system can be anywhere from the solar day if you do it online for a few weeks if done by mitt. Once completed, it may take ii to three days for the straight deposit to reach your account.

What reasons tin can you lot withdraw from 401k without penalization?

Here are some ways to go a free-kick off your IRA or 401 (k)

- Unpaid medical bills. …

- Disability. …

- Health insurance costs. …

- Death. …

- If you are indebted to the IRS. …

- They are buying houses for the offset time. …

- The cost of higher education. …

- For financial purposes.

Is there a penalty for withdrawing from 401k in 2021?

The get-go x% withdrawal penalization is back in 2021. The proceeds from the have are calculated as the tax acquirement for the 2021 year.

What is a skillful amount of coin to retire with at 65?

THE 4-Per centum RULE MAY BE THE Showtime Matter So, if you find yourself wanting to make up to $ 120,000 a year on withdrawal from your savings, according to a 4-percent rule you would need upward to $ 3 one thousand thousand in retirement savings to support that lifestyle. for thirty years. Of course, the 4-percent rule is non far from perfect.

How much should a 65-year-sometime retire earlier retirement? Retirement experts take gear up various rules about how much you want to salve: somewhere around $ 1 million, eighty% to 90% of your annual income before you retire, twelve times your salary earlier y'all retire.

Is 500k enough to retire at 65?

The short answer is yeah – $ 500,000 is enough for some retirees. The question is how it will work. With money like Social Security, low spending, and good luck, this is possible.

How long will 500k last in retirement?

It may be possible to retire at the age of 45, but it depends on a diverseness of factors. If you take $ 500,000 in savings, according to the iv% dominion, you will exist able to earn upward to $ xx,000 for 30 years.

Source: https://www.retirementnewsdailypress.com/at-what-age-can-you-take-out-your-401k-2/

Posted by: mcdanielpridn1990.blogspot.com

0 Response to "What Age Can I Take Money From 401k"

Post a Comment